More than a million workers are expected to lose their jobs by the end of March, economists say, a dramatic turnaround from February when the unemployment rate was near a record low. Ball State University economist Michael Hicks predicts this month could be the worst for layoffs in U.S. history.

The Labor Department reported Thursday that 281,000 people applied for jobless benefits last week, up 33% from the prior week. Economists say it’s only going to get worse. New York restaurateur Danny Meyer’s Union Square Hospitality Group let 2,000 workers go this Wednesday. Pebblebrook Hotel Trust, which oversees 54 hotels, laid off 4,000 employees Tuesday. MGM Resorts and Caesars have begun letting staff go, along with countless smaller restaurants, bars, gyms and coffee shops.

The surge is straining state unemployment offices, which deliver benefits to the jobless so they can buy food and pay rent. On Monday, there were so many people trying to file for unemployment insurance in New York, Oregon and elsewhere that the websites crashed. Newly laid off workers waited hours on poorly staffed phone lines, they said.

As Americans turn to unemployment insurance, some are finding they don’t qualify. Or if they do, the average payment of $385 a week is modest. In some states, there’s a week-long waiting period before the first payment arrives.

„Workers expect unemployment insurance to be there for them in a downturn. A bunch of workers are about to find out that it’s not,“ said Martha Gimbel, a labor economist at Schmidt Futures who was formerly at Indeed.com. „This is a real-life nightmare. Every hole we allowed to grow in our social safety net is hitting us all at once.“

Sean McGuire lost his job as a dishwasher at a popular Portland, Ore., brunch spot on Monday. The restaurant owners gave him brisket, onions and an apology. He spent the rest of the day trying to apply for unemployment, only to be turned down.

„I was on hold with the Oregon Department of Labor for over an hour. They were inundated,“ said McGuire, a 30-year-old Army veteran who served in Iraq a decade ago. „When I finally spoke to a person, they told me I don’t qualify.“

McGuire moved to Oregon on Jan. 1, but he hasn’t worked long enough in the state to receive benefits. He tried to apply in New York, where he previously worked, but the website crashed. After another long wait on the phone, he was told he had not met the requirements there, either, because he quit a previous job. Most states require at least six months of work to qualify for any benefits. Now he’s worried about paying his $1,200 monthly rent on a short-term Airbnb through June.

Many of the newly jobless haven’t been able to file for unemployment benefits yet because the Web portals in their states are down. The problems are exacerbated by low staffing levels at state unemployment offices that didn’t expect such a surge any time soon. In mere weeks, the pandemic is on track to usher in a magnitude of unemployment that took months to reach during the Great Recession.

In Seattle, Ian Vermeers was laid off from his job at a Regal Cinemas movie theater on Monday. He’s been staying up all night to submit his application online and by phone – to no avail.

„I figured maybe things would get better in the middle of the night, but it’s 8 a.m. now and I still haven’t gotten through,“ he said Wednesday. „Every time, I’m immediately hit with, ‚Sorry, our system is not working right now.'“

Many economists are urging Congress to quickly boost funding for state unemployment insurance. The Families First Coronavirus Response Act that President Donald Trump signed Wednesday included $1 billion to help states with administrative costs of processing unemployment insurance, but additional stimulus will be needed to cover more people. Twenty-three states were already running low on money in their unemployment trust funds before the pandemic hit.

Congress also has the power to increase the amount of unemployment dollars laid off workers receive and to extend benefits to self-employed and „gig“ workers, as happens during natural disasters. Sixteen states have such restrictive criteria that fewer than 20% of laid off workers in the state are able to get unemployment benefits, according to the left-leaning Center on Budget and Policy Priorities.

„I’m terrified that states aren’t recession-ready anymore,“ said Michele Evermore, senior policy analyst at the National Employment Law Project. „States have reduced the amount of benefits and access to benefits in a way that means that very few people can apply for unemployment insurance and receive it.“

Contractors, tipped workers, full-time students and undocumented workers often do not qualify for unemployment benefits, labor advocates said. Waiters and hotel staff who lose jobs are especially vulnerable, because they tend to move jobs frequently and rely on tips – factors that states handle differently. Plus, many states require applicants to prove they are searching for full-time work, although a few states including Texas have begun waiving the requirements.

Shawna, an exotic dancer who spoke on the condition she be identified only by her first name, found out Monday by text message that she would be out of work for at least two weeks. Unlike the bartenders and bouncers who work with her at a gentlemen’s club near Philadelphia, she does not qualify for unemployment insurance because she is a contractor.

She used to make $1,300 in a good week. Now the 31-year-old isn’t sure how she’ll be able to pay her rent or afford food without a steady income.

„The whole system is set up in a really bad way for us,“ she said. „We are completely on our own right now.“

So far, the wave of coronavirus-related layoffs has disproportionately hit service workers in typically lower-paying jobs. Many lack adequate savings and say they don’t know where to turn as restaurants, bars, cafes and shops across the country shut their doors indefinitely.

Nellie Hana, a full-time student and line cook at an Olive Garden in Buffalo, New York, said managers this week told kitchen staff they had a choice: They could be laid off and file for unemployment, or they could keep working five hours a week processing to-go orders.

For Hana, unemployment wasn’t an option. Full-time students don’t typically qualify for unemployment benefits. She chose to keep working, even though that means her $600-a-week job will now bring in less than $70 each week.

„I have no choice but to wait this out,“ said Hana, 20, who is majoring in media production at SUNY Buffalo State College. „I have student loans and bills to pay. Rent is coming up. Past that, I don’t know how I’m going to eat.“

Rich Jeffers, a spokesman for Olive Garden’s parent company, Darden Restaurants, said the company has not laid off any employees, though many restaurant workers have had their hours reduced to zero, as mayors and governors order dining rooms to close. The company, he said, is providing emergency pay of up to two weeks to affected employees.

For workers, one of the most frustrating aspects is the uncertainty. No one knows how long the pandemic and near-lockdown of the economy will last, and some workers have found themselves in limbo – not technically laid off, but also not getting paid.

Several big companies, such as Marriott International, are furloughing tens of thousands of workers. Halliburton announced furloughs of 3,500 employees at its Houston campus starting next Monday, because of the huge hit to oil prices this month. Furloughs allows workers to keep their health-care benefits, though they have no income coming in.

American Eagle is among a growing number of retailers closing its stores through late March. The company has pledged to pay employees for the hours they are scheduled in coming weeks. But an employee in a New York store said managers recently scrapped the original schedule and created a new one that only includes managers, which means she – and the majority of her co-workers – won’t be paid.

„I’ve worked up to 40 hours a week for more than three years,“ said the employee, who spoke on the condition of anonymity because she feared retribution at work. „I’ve never received zero hours. I don’t know what to do.“

American Eagle didn’t return a request for comment.

Workers whose hours are severely reduced are supposed to be eligible for partial unemployment benefits, but state rules vary, and workers often have to file an appeal if an initial claim is denied.

One proposal in the works that could help the unemployed is a move backed by the White House to send $1,000 checks directly to workers, possibly twice. That’s just a small comfort for McGuire, however, who made more washing dishes in Portland.

„If you’re in a major city, that $1,000 doesn’t pay your rent, let alone health care, transportation and food,“ he said. „My financial situation is in complete disarray.“

As Usual, Americans Must Go it Alone

Americans are no less susceptible to disease, joblessness, and family changes than their peers in rich nations, but they are made more fragile by these crises. The country has a thinner safety net, fewer public goods, and less social insurance than other countries. The United States spends roughly what other Organization for Economic Cooperation and Development nations do on pensions, or Social Security, and more on health care, for less coverage and worse outcomes. It spends less than a third of what the average OECD country does on helping the jobless, about a third supporting families with kids, and 50 percent less on incapacity, meaning disability, sickness, or injury that might keep a person from accessing the labor market.

Franklin Foer: NIH Director: ‘We’re on an exponential curve’

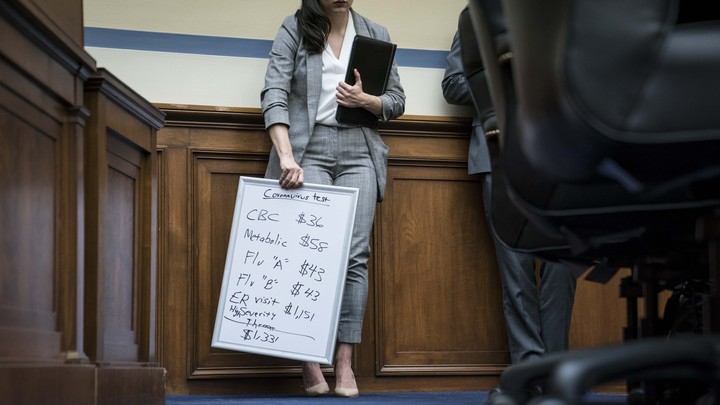

Perhaps the country’s most pressing problem is its high uninsured rate. Every other country as wealthy as the United States has figured out how to cover its entire population, generally at a much lower cost, too. But roughly one in 10 Americans lacks any form of health-insurance coverage, which may lead them to delay seeking out medical help when they need it. For many of those with coverage, health care is still unaffordable and inaccessible. The average American family with private coverage pays $6,015 a year for insurance, on top of what their employer pays. On top of that, the average individual has a deductible of $1,573, meaning they need to spend that much out of pocket every year before their coverage kicks in. On top of that, many plans come with required “co-insurance” payments that are applied even after a person hits their deductible. These costs discourage sick individuals with insurance from seeking care. They also saddle American families with tens of billions dollars of debt a year: Two-thirds of American bankruptcies are related to medical bills.

What does this mean today? That Americans will avoid getting tested for the coronavirus and will avoid getting treated for COVID-19. That some untold number could go into debt, lose their homes, or declare bankruptcy because of the global pandemic—strains that will in turn do measurable damage to public health. Although the Centers for Disease Control and Prevention has promised that coronavirus testing will be free, it has not promised that the cost of care will be, leaving open the possibility that the uninsured will choose not to receive treatment, imperiling their own health and the health of others around them.

The government also fails to protect its people by not guaranteeing paid family leave and paid sick leave. These are benefits mostly granted by large employers; just a handful of states and cities operate mandatory paid-leave programs. One in three workers in the private sector has no paid sick days at all. Two in three do not have a short-term disability plan. And four in five do not have paid family leave. Congress recently expanded paid leave in response to the crisis, but not to all workers and not in any comprehensive way. That means that workers need to quit their jobs to attend to their dying parents. It means that a frightening share of workers in customer-service positions go to work no matter how sick they are, because they cannot afford to miss a paycheck. It means that the coronavirus pandemic will spread more easily, and cause more harm.

“From a worker perspective, there’s so much precarity related to what you might have access to and who controls it,” Vicki Shabo, a paid-leave expert at New America, told me. “From an employer perspective, most employer policies aren’t set up with the idea that a pandemic might substantially change operations for a long period of time. It shows that the lack of a public infrastructure to deal with a situation like this affects both employers and employees.”

Annie Lowrey: The coronavirus recession will be unusually difficult to fight

The country does have an unemployment-insurance system that kicks in automatically to help people when the economy tanks—but it is hardly robust. Since the 2008 financial crisis, several states have slashed the number of UI payments people get after losing their job. They have tightened eligibility requirements. And they have reduced payments. Similarly, the Trump administration and many states have made it much harder to get payments from the Supplemental Nutrition Assistance Program. During a coronavirus-induced downturn, families will be at greater risk for food insecurity, eviction, and job loss; kids will go hungry; food pantries and social-service organizations will come under more strain.

All of this means Congress must act to provide families with sufficient benefits when a recession hits. But Congress is sclerotic, putting the country at extraordinary risk. “We have very little reason to assume that we’ll have the elected officials in place to take the necessary action,” Indivar Dutta-Gupta, the co-executive director of the Georgetown Center on Poverty and Inequality, told me. “I constantly hear people say that when there’s enough of a crisis, Congress will take action and turn something on. There’s nothing in our experience that suggests that’s correct.”

Read: It pays to be rich during a pandemic

The United States also crucially underinvests in its children, with less public spending on preschool, childcare, and family allowances than nearly every other OECD country. That means American children are more likely to live in poverty than children in most other rich nations. This is already a catastrophe. It stands to become a worse one with the coronavirus pandemic. Millions of low-income families will see a breadwinner become sick or lose work. Millions of kids will lose what little safety they have.

Americans want to change this state of affairs: Paid leave, better unemployment-insurance programs, more affordable insurance, getting kids out of poverty—these are uncontroversial, bipartisan priorities. But our political system is not set up to move quickly and boldly. This crisis cannot go to waste, although it almost certainly will. And when the next pandemic or financial crisis or downturn hits, millions of families will face it alone

The $1 trillion stimulus isn’t about cash. It’s about restoring faith in the system.

The only question is how deep and prolonged the pain will be. And unlike the 2008 crash, a calamity concocted in the laboratories of Wall Street that spread through society, this one comes from the real world; high finance is only one of its many victims.

At such times, policymakers and pundits inevitably turn to John Maynard Keynes, the economist who spent nearly half a century thinking about how to respond to moments like this one. He is best known for his teaching that governments should run budget deficits to tackle recessions: Spend money, even if you have to borrow it, to get the country back on its feet. „We are going to need to get large amounts of money,“ Nobel laureate economist Joseph Stiglitz recently told CNBC, „to those people who are going to be under enormous stress.“

But Keynes wasn’t just a prophet of numbers. His insights were much broader, folding psychology, ethics and even military strategy into a unique body of work that, if deployed correctly today, can do more than lift the Dow. For Keynes, economics was not a science of dollars and cents, interest rates and inflation. It was about the way people think and live. Economics is large-scale therapy to calm anxious minds – in other words, exactly what we need today.

Economists historically have assumed that human beings are rational individuals bent on maximizing their own profits. Keynes instead based his work on imperfect people navigating life’s uncertainties. It’s impossible to make a simple decision about what’s best if you don’t know what the future will bring. You can’t calculate your personal advantage when you can’t see past the horizon.

Keynes was shocked by the outbreak of World War I. Investors had not planned for a sudden, monumental change in global commerce. War abruptly turned trading partners into armed enemies. It upended turn-of-the-century trends toward globalization, rupturing free trade between independent nations in much the same way the coronavirus now threatens to disrupt 21st-century globalization. Just as businesses then didn’t know who would win the war, investors today don’t know what workforces and supply chains will be destroyed, which will recover, or when.

Keynes soon recognized that life was littered with such surprises. No matter how detailed a company’s financial statements and regulatory filings might be, they could not provide the most important information about profitability – they could not predict what they did not expect. Over the course of the 1920s and 1930s, Keynes watched as the British economy failed again and again to recover from the shock of World War I. This should have been impossible. No matter how incompetent or corrupt the government might be, at some point markets should restore a prosperous equilibrium of full employment and shared prosperity. They did not. More than 1 million British men remained out of work for more than a decade, eventually escalating to more than 3 million in the early 1930s.

As he wrote in his magnum opus, „The General Theory of Employment, Interest and Money,“ it was „animal spirits“ and „a spontaneous urge to action“ that inspired economic decisions – not a clear-eyed calculation of future profits. Financial markets were uniquely unsuited to deal with uncertainty. Sudden events that changed the outlook, such as a war or a pandemic, made it impossible to know where money could be made. And the markets were not divining the true value of anything by a morass of confused bids and sales based on business leaders‘ best guesses. Ill-informed decisions just amplified the chaos.

Political leadership alone could lead a society out of a crisis like the coronavirus crash. The key was not simply lowering tax rates or increasing purchasing power, but convincing the public that eventually things would, in fact, be all right. Markets could not function until political leaders revived confidence. When Franklin D. Roosevelt broke with the gold standard and embarked on the New Deal, Keynes hailed the new president’s decision as „the only possible means by which . . . confidence in a monetary economy restored.“

Cheerleading by itself, however, could not work. Herbert Hoover spent many of the early years of the Great Depression telling the world that prosperity was just around the corner, but few believed him, because they could not feel the impact of his words in their pocketbooks. When Roosevelt declared that „the only thing we have to fear is fear itself,“ the message resonated, because Roosevelt was busy restructuring the American financial system. Rhetoric had to be matched with action. That, presumably, is what the Fed had in mind with its recent interest rate cuts and pledges to support the credit markets – and what the Trump administration hoped to telegraph with its request for $1 trillion in congressional spending to combat the economic effects of the virus.

For Keynes, action meant bolstering the confidence not only of investors but of ordinary people. He advocated direct aid to working families and called for the government to create thousands of new jobs on public-works projects. These were intended to increase gross domestic product, yes, but also to make people believe in the prospect of better times ahead. In the 1940s, he even worked as the financial architect for the plan to socialize British medicine into the National Health Service. For Keynes, this was partly a question of general welfare – but it was also about making markets work. If ordinary people didn’t have to worry about their health care disappearing in a financial crisis, the crisis itself would be less severe.

In the coronavirus crash, Keynes would advocate immediate, direct financial aid and health-care benefits to working families. He would be gladdened by exhortations from members of Congress from both parties, not to mention the White House, for cash payments from the government to Americans. He would also no doubt endorse government support for corporations. When the interwar economic crisis came to a head in Britain in 1926 with a ruinous general strike, Keynes called for government support of businesses and workers alike – through exchange rate relief and monetary policy, if no other means could be negotiated.

Still, Keynes was skeptical about the ability of the private sector to lift society out of economic doldrums. Government would have to establish a parallel economy of public goods and public services to prove there were things that could be achieved and goals that could be met, even when private industry was too frightened to take the plunge. „There is no reason why we should not feel ourselves free to be bold, to be open, to experiment, to take action, to try the possibilities of things,“ he wrote in 1929, calling for the British government to invest in a massive new project of road-building, rural electrification, public housing and park construction that foreshadowed much of FDR’s New Deal.

Today, the United States is plagued not only by a devastating virus but by decrepit infrastructure, a broken health-care system, and an obvious shortage of medical supplies and capacity for treating the coming calamity. Keynes would envision an almost militarized government response of hospital-building and health-care delivery, including refurbished roads and bridges, sanitized public transport, and all-hands-on-deck training for nurses and health-care providers, accompanied by generous pay to encourage people to sign up for what will no doubt be dangerous work.

This would all be very expensive – trillions of dollars. But Keynes insisted that governments that controlled their own currencies had far more to worry about from a collapse in confidence than a spike in debt. Take care of confidence, and the economic rebound will take care of the debt. „The idea that [a large deficit] represents a desperate risk to cure a moderate evil is the reverse of the truth,“ Keynes wrote in 1929. „It is a negligible risk to cure a monstrous anomaly“: the collapse of the global economy. Over the past 90 years, even conservatives have come to agree with him, at least when they wield power in Washington. From Richard Nixon to Ronald Reagan to George W. Bush to Donald Trump, Republican politicians have run up massive deficits in the name of economic growth – and they have done so without causing a collapse in confidence or a financial crisis.

Over the coming weeks, economists and politicians will put forward dozens of plans to boost output, salvage struggling industries and encourage consumer spending. But the most important lesson from Keynesian economics is not about money – it’s about belief. What matters now is the collective faith in a better future. There are many avenues to securing this faith, but it can be supplied only by politicians.

One of Keynes‘ most famous aphorisms is his declaration that „in the long run, we are all dead.“ But he also wrote that „in the long run, almost anything is possible.“ That is the spirit our leaders must now harness.